35+ depreciation tax shield calculator

How to calculate after tax salvage valueCORRECTION. Web Enter the applicable tax rate and the total depreciation that can be deducted into the calculator to determine the depreciation tax shield.

Hard Rock Miner S Handbook Ufrgs

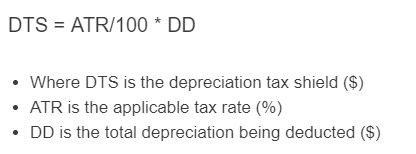

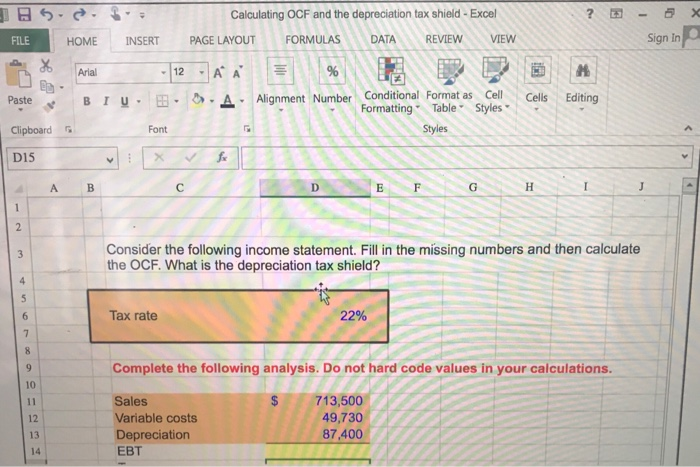

The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below.

. How to calculate tax shield due to depreciation. Get Prepared To File Your Taxes. The recovery period of property is the number of years over which you recover its cost or other basis.

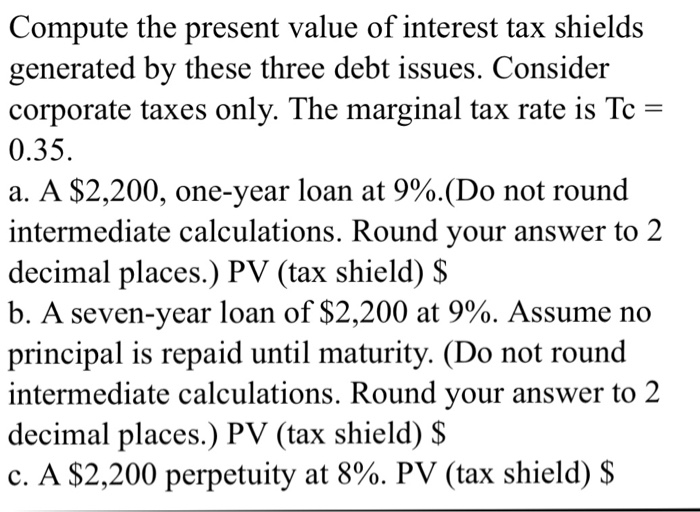

Web 49 86142 ratings Step 1. Web The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. Is a tax factor that covers the impact of income taxes the depreciation tax shield and investment tax credits.

Web The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Access Our Tax Estimator Tools At Anytime Anywhere. So if you had total deductible expenses of 15000 and a tax rate of.

C is the original purchase price or basis of an. Where Di is the depreciation in year i. See Your Estimate Today.

Web per kWh and cas the levelized capacity cost of the facility per kWh. Web Interest Tax Shield Example. Or the concept may be applicable.

Depreciation is the normal wear and tear in the asset of the. Fantom an oil refining firm has an aggregate annual tax deductible. Calculate the amount of Depreciation to be debited to the profit and loss account.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. It is determined based on the depreciation system GDS. D i C R i.

Web You can calculate a tax shield with this formula. Web Depreciation Tax Shield Formula. Web The tax rate for the company is 30.

Interest Tax Shield Interest Expense. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a. So the total tax shied or tax savings.

See Your Estimate Today. This companys tax savings is equivalent to. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900.

Tax shield Deduction value Tax rate. Get Prepared To File Your Taxes. Ad Quickly Calculate Your Tax Refund So You Know What To Expect.

Access Our Tax Estimator Tools At Anytime Anywhere. Web After-tax benefit or cash inflow calculator. Web How to calculate NPV.

Ad Quickly Calculate Your Tax Refund So You Know What To Expect. In the line for the initial cost. Web The MACRS Depreciation Calculator uses the following basic formula.

Depreciation tax shield calculator. Web Depreciation tax shield Tax admissible depreciation x Applicable tax rate. Web How to calculate the tax shield.

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Depreciation Tax Shield Calculator Calculator Academy

Solved Compute The Present Value Of Interest Tax Shields Chegg Com

Tax Shield Formula Step By Step Calculation With Examples

What Is The Depreciation Tax Shield The Ultimate Guide 2021

What Is The Depreciation Tax Shield The Ultimate Guide 2021

2 Effect Of Inflation On 1 In Depreciation Tax Shield For Different Years Download Table

Co9fmiujr0zu2m

Depreciation Tax Shield Calculator Calculator Academy

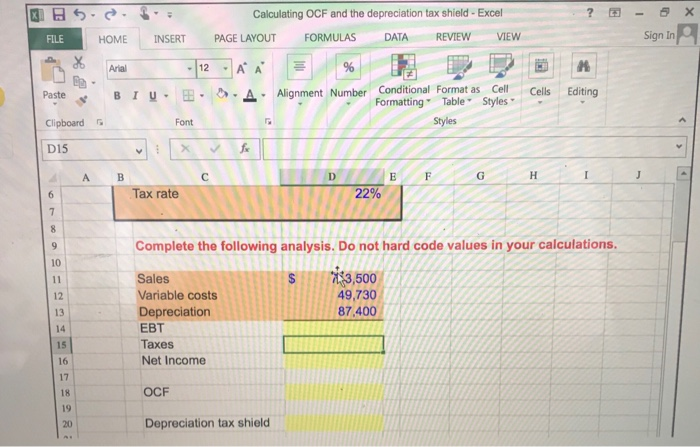

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

Pdf Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Do We Consider Tax And Accelerated Depreciation To Calculate Internal Rate Of Return Quora

Tax Shield Formula How To Calculate Tax Shield With Example

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Calculate Present Value Of Interest Tax Shield 16 3 Youtube

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com